Teachers' Pensions

Setting Up

To set up your Teachers' Pension, first create a scheme in the usual way and manually enter the details.

Once created you should go to the Provider tab and change the CSV Format to "Teachers' Pension MDC".

Now switch to the Worker Groups tab and edit the default Worker Group that was created by clicking on it.

From the Contribution Level Type drop-down list, choose "Teachers Pension England & Wales (Beta)".

You'll now see inputs for you to provide the Local Authority Number and the School/Employer Type Number. These are used on the MDC file.

Click "Update" to save your changes to the Worker Group and then the "Update Pension Scheme" button

Adding Employees

Previously enrolled employees join the Teachers' Pension in the same way as any other pension. Although you'd choose "Contractual Pension" instead of "Enrol".

Similarly you can set it as a default pension for new employees just like any other pension.

Employee Pension Details

There are fields required for Teachers' Pensions that aren't needed for other types.

When looking at en employee record you can switch to the "Pension" tab and click "Edit Pension" to access these details. Note that these additional fields only appear if the employee is a member of a a Teachers' Pension Worker Group.

Tier

You can choose a specific tier for the deductions or you can leave it set to "Auto" and we'll calculate the appropriate tier based on what the employee is paid in each period. See "Non Tierable Pay" pay below.

Employment Type

Select the appropriate option. This is included in the MDC file.

Full Time Salary

Enter the full time salary to report in the MDC file. If this is empty then we'll calculate a value based on the employees pay options.

Salary Paid

If the employee isn't Full Time then you can enter the amount to report as the salary paid on the MDC.

If this is empty then we'll report the actual amount paid to the employee on the pay run.Member No

This field is optional for others types of pensions, but must be completed for a Teachers' Pension member.

This is typically a 7 digit number. Please do not include the oblique(“/”).

Non Tierable Pay

If you chose "Auto" as the tier then we'll look at the amount the employee is paid each period and select the appropriate tier.

But if you pay back pay or overtime you probably wont want this included in the amount we look at to determine the appropriate Tier.

To deal with this you must create a pay code to use, and in the Advanced Settings for the code, tick the box that says "Doesn't count towards determining pension tier".

Now any payment lines that are assigned to this code will be ignored when determining which tier to use.

MDC File

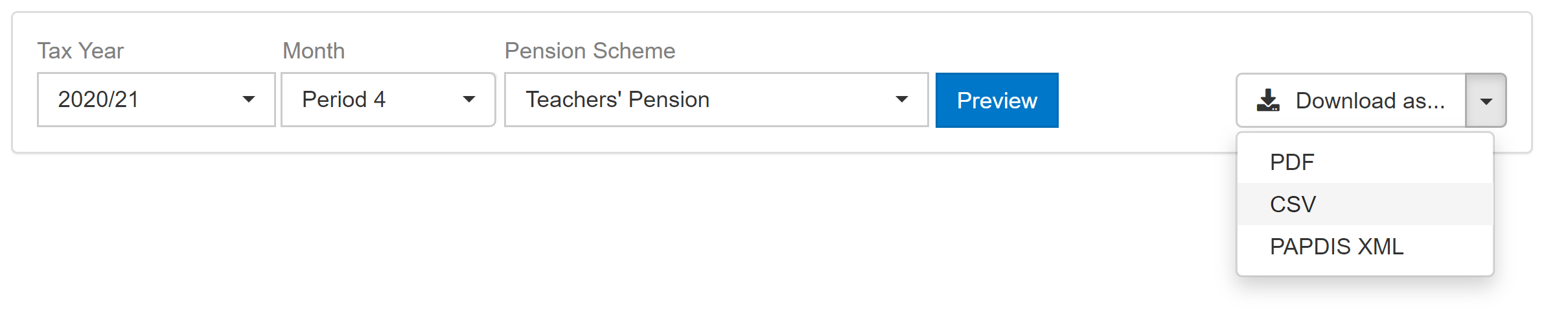

Go to the main Reports tab. Switch to the "Pensions and AE" sub tab and run the Assessment report for the given period.

Note this report is also accessible under the Pensions tab by clicking "Contributions" when viewing a Pension Scheme and is also linked to on the pay run finalised page.

Click the "Download as..." button and choose "CSV".

You should now receive the MDC file and it should already be named appropriately