Import Umbrella Amounts (CSV)

When viewing the pay run, look for the "Import Payments" button near the bottom-left of the page. Click this button.

As long as you have enabled the Umbrella Settings then you will

see an option to upload a CSV file.

As long as you have enabled the Umbrella Settings then you will

see an option to upload a CSV file.

Use this feature to upload details about multiple umbrella payments in one go.

Column Headings

Whilst the headings can appear in any order in your CSV file, the names of the columns must be exactly as shown below.

Code

This is a required column. It should contain the Payroll Code of the employee you wish to pay.

Amount

Also a required column. The invoice amount.

Hours Optional.

The number of hours worked. Will default to 40 if not supplied.

Timesheets Optional.

The number of timesheets this payment covers. The Charge is multiplied by this value. Will default to 1 if not supplied.

Mileage Optional.

If the employee has a vehicle type set then you can choose how many miles to claim. Defaults to 0

Expenses Optional.

Any additional expenses the employee is claiming to reduce the taxable value. Defaults to 0.

Charge Optional.

The charge per timesheet to apply to this payment.

Defaults to whatever value you set in your Umbrella Settings.

Review and Upload

Once you have submitted your file, assuming there are no errors then you will be shown a preview of what you are about to import.

If you're happy with what you see then go ahead and click the "Import Umbrella Payments" button.

The payments are applied to the employees and you are taken to the payroll view where you can see the results.

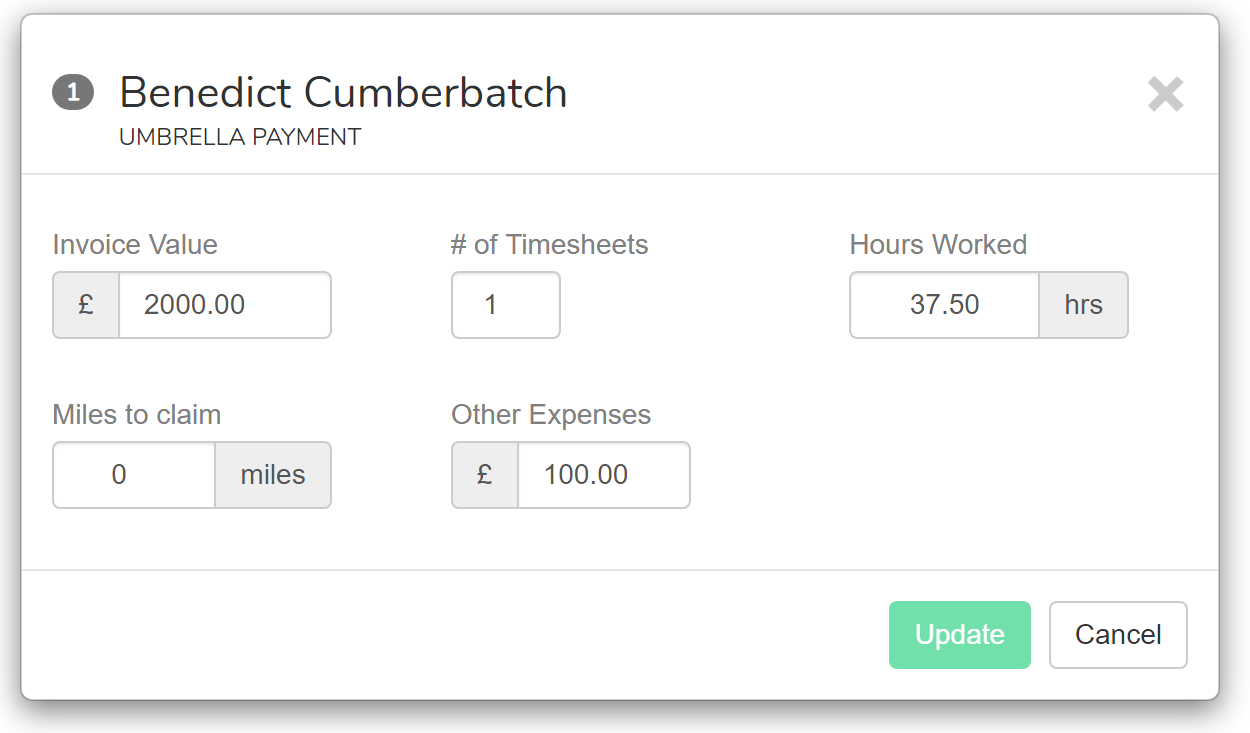

You can edit any individual entry by clicking on it in the list and then clicking on the icon as detailed here.