Adding an Attachment Order

To add an attachment order:

- Click the 'Employees' link in the main menu

- Select an employee from the list

- Click on the "Attachment Orders" tab.

- Click the button to add a new AEO

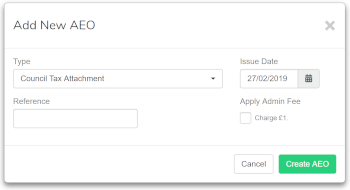

Initial Details

You're first asked for basic details about the order.

Type

It's important to choose the right Type as this will determine how deductions are calculated and what options are available to you on the next page.

Issue Date & Reference

There should be a date and reference on the document you received. Enter them here.

Admin Fee

You're allowed to charge your employees a £1 admin fee for each AEO you have to process. Tick this box if you want to charge this fee.

Further Details

Once you've created the AEO you'll see more options.

The options presented depend on the type of order you created, but we'll go through all of the possible options here.

Start Date

This is the date in which to start applying the order

End Date (optional)

If an end date is set then this order will automatically be stopped on that date

Deduction

The amount to deduct as either a fixed amount or a percentage. If this isn't shown then it's because we automatically work out the deduction amount for the type or AEO chosen.

Protected Earnings

Some orders define a level of 'Protected Earnings'. This ensures the employees pay doesn't fall below a certain level. If your order states a protected earnings amount then enter it here.

Total Amount To Pay

If there is a total amount to pay for the order then enter it here. Once the amount has been reached we will automatically stop the order.

Previously Paid

If there is a total amount to pay then it's possible the employee has already made contributions towards it, either in a previously payroll package or previous employment. If so, you can enter the amount here. You may have to click 'Opening Balances' for this box to show

Starting Arrears

Some orders require that any shortfall in previous payments is carried forward. If this is the case then you'll see a box for Starting Arrears (you may have to click 'Opening Balances' for this box to show. If there are any arrears then you can enter them here. You don't need to worry about arrears accumulated in the future as we do this automatically.

Save the Attachment Order and it will automatically be processed in pay runs where it is applicable.