Payment After Leaving

If you need to give an additional payment to an employee after they have left then it needs to be dealt with in a specific way to comply with HMRCs rules.

Go to the main Employees tab and click on the "Former" sub-tab.

After clicking on the relevant employee you should switch to their "Employment" tab.

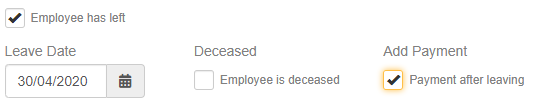

From there you can tick the box to say you want to add a payment after leaving.

The employee will be automatically added to the next pay run (or the current pay run if it is still open).

You can add a payment in the usual way. Note that we've forced the tax code to be 0T so that there is no personal tax allowance.

Once you've finalised the pay run then the "Payment After Leaving" checkbox on the employee record will be cleared so the employee doesn't appear on the next pay run.

The payment will be reported to HMRC on the FPS.

A Payment After Leaving doesn't increase the values on a P45 and you should not re-issue a P45 after making the payment.