Sending Employee Documents

Once you connect to an Employee Portal then we can send documents to your employees.

Payslips

When the pay run has been finalised, you'll see a button to send the payslips to the portal.

A single click is all it takes to send all payslips across.

You can return to the pay run Finalised page at any point to re-send the payslips if needed.

P60s

You can send an individual P60 to the portal just by viewing it under the 'Reports' section and clicking the button that appears to send the P60.

When you close a tax year, if you're connected to an Employee Portal then you'll have a checkbox to automatically send all P60s for the year to the portal.

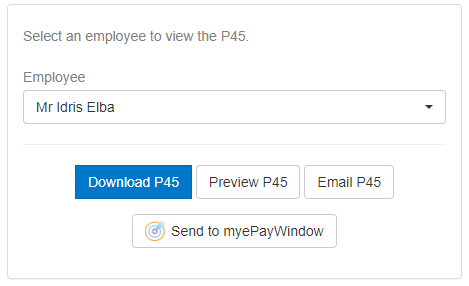

P45s

When you are viewing a P45 you'll see a button to send the document to the Employee Portal.

You can access the P45 from the employee screen or via the 'Reports' section.

P11Ds

First you need to create your RTI document for sending your P11D(b) and related P11Ds to HMRC.

This is done by going to the main RTI tab and then choosing the EXB section.

Create the EXB for the relevant year and you should then see a button appear allowing you to send all P11Ds to the Employee Portal