Mileage Allowance Payments

If an employee used their own car for business purposes then you can pay them a set amount per mile tax-free without any need to report details to HMRC.

The amount you can pay depends on the type of vehicle and the number of miles already paid for in the current year.

We make this easy for you by allowing you to enter the number of miles and type of car, we then take care of the relevant calculations.

Employee Setup

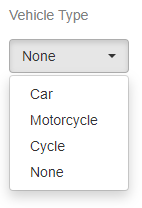

First you need to edit the employee record to set the type of vehicle they're using.

When viewing the employee record, click on the 'Pay Options' tab and the 'Other' section.

You'll see an option to select the vehicle type.

Select the relevant option.

Adding a Payment

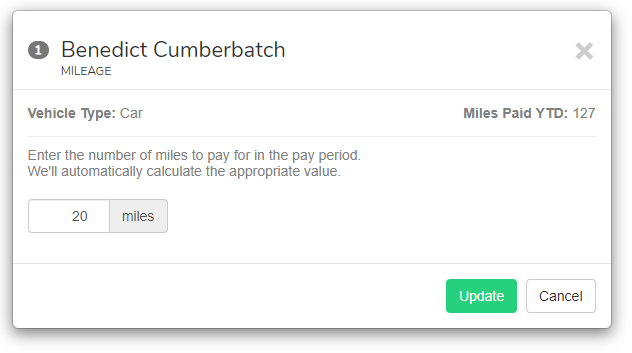

Now start your pay run as usual. Click on the employee in the list of payments.

At the bottom of the window that opens you'll see a link to "Add Mileage".

Click on it and you'll be asked to enter the number of miles you wish to pay for and click update.

A new line is added to the payslip showing the number of miles and the amount paid per mile.

If you need to change the number of miles just click on this line, enter the new mileage and click Update.

We automatically keep track of how many miles have been paid for in the current tax year and reduce the rate accordingly.

Opening Balances

If you're starting with us mid-year then you should enter the number of miles the employee has been paid for already to ensure we're paying the correct amount.

First set the Vehicle Type for the employee as detailed above. Then go to the employees Opening Balances page (accessible from the 'More' drop-down menu).

If the Vehicle Type you've selected has a varying rate then you'll see a box at the bottom of the Opening Balances page to set the amount of miles paid so far.